Are you thinking about getting a personal loan of 5 lakhs? Maybe you need it for a big purchase, any kind of emergency or something related to pay off other debts. Whatever the reason, it’s important to find a loan that offers low interest and easy repayments. This way, you can manage your money better without feeling stressed. Here’s how you can do it.

How to get a personal loan of 5 lakhs with low interest

- Understand Your Credit Score

Your credit score is a big deal when getting a personal loan. It’s a number that shows how good you are at paying back borrowed money. If your credit score is high, banks will trust you more and give you loans with lower interest rates. You can check your credit score online for free. If it’s not great, try to improve it by paying off small debts and not missing any payments.

- Compare Different Lenders

Different banks and financial companies offer different loan options. It’s a good idea to compare them before making a choice. Look at the interest rates, repayment periods, and any extra fees they might charge. Some lenders might have hidden charges, so read the fine print carefully.

- Choose the Right Repayment Period

When you apply for a loan, you’ll need to choose how long you want to take to pay it back. This is called the repayment period. A longer repayment period means smaller monthly payments, but you’ll pay more in interest over time. A shorter repayment period will have higher monthly payments, but you’ll save on interest. Pick the one that fits your budget best.

- Consider Pre-Approved Loans

Some banks offer pre-approved loans to their existing customers. If you have a good relationship with your bank, they might offer you a personal loan with a low interest rate and easy terms. These loans are usually processed quickly because the bank already knows your financial history. Check with your bank to see if you qualify for this option.

- Negotiate for Better Terms

Don’t be afraid to negotiate with the lender. If you have a good credit score or a stable income, you can ask for a lower interest rate or a longer repayment period. Some banks are willing to adjust their terms to keep good customers. It never hurts to ask!

- Read the Loan Agreement Carefully

Before you sign any loan agreement, make sure you understand all the terms and conditions. Check for any hidden fees, penalties for early repayment, or conditions that could change the interest rate. If anything is unclear, ask the lender to explain it. It’s better to be safe than sorry.

- Apply Online for Quick Approval

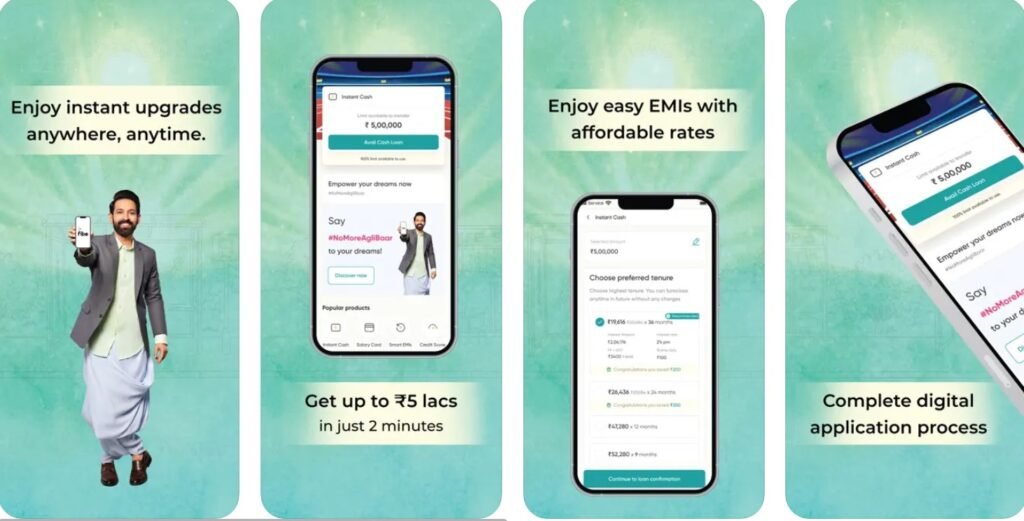

Many banks and financial institutions now offer online applications for personal loans. Applying online can be quicker and easier than visiting a branch. You can also upload your documents and get approval in just a few days. This is a convenient option if you need the loan quickly.

Conclusion

Getting a personal loan with low interest and easy repayments is possible if you take the right steps. Start by understanding your credit score, comparing lenders, and choosing the right repayment period.

By following these tips, you can find the best personal loan for your needs and manage your finances without stress.